Greedy Big Tobacco Raises Cigarette / Tobacco Prices BEFORE theTobacco Tax Increase goes into Effect!

Wake Up, tobacco users of all kinds (except cigars): the Tobacco War of 2009 has already begun. It’s going to get bloody too.

It’s a shame DallasNews.com, the on-line version of the Dallas Morning News, believes only short stories will bring visitors to the site. This article on www.dallasnews.com leaves out many of points relevant to tobacco users in general. Fortunately, I’m here to fill the missing blanks.

On April 1st; I guess tobacco users are the fools this April Fools Day, the Federal Cigarette Tax rises. Brand-Loyal Smokers received a further twisting of the knife from their favorite Big Tobacco Companies.

Quoting the Newspaper version of the story, “While the federal tax bump is not effective until April 1, tobacco companies began raising their prices this month in anticipation of the higher tax and the attendant drop in sales because of the increase.”

Altria, owner of Philip Morris, has already raise the price on a pack of Marlboro and other popular brands they control 71 cents a pack…and they did it Two Weeks ago! And why 71 cents a pack when the Federal Tax increase on cigarettes is only 61 cents a pack? Could it be…oh, I don’t know…Profiteering!

Our friends at R.J. Reynolds raised the prices on Camel, Kool, Salem, Winston and their other popular brands by 44 cents a pack.

Lorillard…who knows what they do? They refuse to talk to anyone, especially me, even about public information on their website. As Triumph Snus wallows in the mud, they cling to the fantasy that Newport alone can support the company. More about Lorillard in my next article.

What is NOT mentioned anywhere in either the DallasNews.com story or the Dallas Morning News print version is that cigarettes are not the only products affected: ALL smokeless tobacco including snus sees huge increases in taxes. That is of course, except for cigars which somehow managed to have their tax rate LOWERED.

This does bring opportunity for Snus Users, however. Swedish Match AB, the largest snus producer in Sweden with a 95% market share, also happens to be about the largest distributor of Cigars on the planet. As evidenced by the favorable treatment cigars get in every piece of U.S. tobacco legislation, Swedish Match’s lobbyists in Washington must be absolute masters of their craft.

They obviously don’t want to do anything to hurt their cigar market, but since they could probably care less about cigarettes in the United States, why not have these Master Lobbyists start handing out Real Swedish Snus to our elected officials and bureaucrats in Washington? Let them work their magic for Swedish Snus they way they do for cigars.

They’ll have to act quickly, though. Camel SNUS is available in Washington DC and the surrounding areas. I don’t know about Marlboro snus, and I do know Lorillard isn’t even worth inviting to the party. They’re just going through the motions in their two little test markets.

Here’s the link to the DallasNews Article, Federal Cigarette Tax to Go Up 61 Cents a Pack.

Here is a link to my friends at GovTrack with all the details on HR-2, The CHIP Reauthorization Act of 2009 as amended, now known as Public Law 111-3.

Here’s the section buried in PL 111-3 that Snus, Smokeless Tobacco, and Cigarette Smokers have to be concerned about….and what Cigar Smokers are rejoicing over. The yellow highlights are just plain wrong. The orange ones affect snus.

TITLE VII–REVENUE PROVISIONS Once again, tobacco users (except cigar smokers) are arrogantly and punitively taxed for…wait for it…The CHILDREN! Not entirely though; SEC 703 works on the assumption that anyone who buys tobacco products over the internet is at best a tax thief, and at worst, a terrorist. Really. Read it and weep.

SEC. 701. INCREASE IN EXCISE TAX RATE ON TOBACCO PRODUCTS.

(a) Cigars- Section 5701(a) of the Internal Revenue Code of 1986 is amended–

(1) by striking ‘$1.828 cents per thousand ($1.594 cents per thousand on cigars removed during 2000 or 2001)’ in paragraph (1) and inserting ‘$50.33 per thousand’,

(2) by striking ‘20.719 percent (18.063 percent on cigars removed during 2000 or 2001)’ in paragraph (2) and inserting ‘52.75 percent’, and

(3) by striking ‘$48.75 per thousand ($42.50 per thousand on cigars removed during 2000 or 2001)’ in paragraph (2) and inserting ‘40.26 cents per cigar’.

(b) Cigarettes– Section 5701(b) of such Code is amended–

(1) by striking ‘$19.50 per thousand ($17 per thousand on cigarettes removed during 2000 or 2001)’ in paragraph (1) and inserting ‘$50.33 per thousand’, and

(2) by striking ‘$40.95 per thousand ($35.70 per thousand on cigarettes removed during 2000 or 2001)’ in paragraph (2) and inserting ‘$105.69 per thousand’.

(c) Cigarette Papers- Section 5701(c) of such Code is amended by striking ‘1.22 cents (1.06 cents on cigarette papers removed during 2000 or 2001)’ and inserting ‘3.15 cents’.

(d) Cigarette Tubes- Section 5701(d) of such Code is amended by striking ‘2.44 cents (2.13 cents on cigarette tubes removed during 2000 or 2001)’ and inserting ‘6.30 cents’.

(e) Smokeless Tobacco– Section 5701(e) of such Code is amended–

(1) by striking ‘58.5 cents (51 cents on snuff removed during 2000 or 2001)’ in paragraph (1) and inserting ‘$1.51’, and

(2) by striking ‘19.5 cents (17 cents on chewing tobacco removed during 2000 or 2001)’ in paragraph (2) and inserting ‘50.33 cents’.

(f) Pipe Tobacco- Section 5701(f) of such Code is amended by striking ‘$1.0969 cents (95.67 cents on pipe tobacco removed during 2000 or 2001)’ and inserting ‘$2.8311 cents’.

(g) Roll-Your-Own Tobacco– Section 5701(g) of such Code is amended by striking ‘$1.0969 cents (95.67 cents on roll-your-own tobacco removed during 2000 or 2001)’ and inserting ‘$24.78’.

(h) Floor Stocks Taxes-

(1) IMPOSITION OF TAX- On tobacco products (other than cigars described in section 5701(a)(2) of the Internal Revenue Code of 1986) and cigarette papers and tubes manufactured in or imported into the United States which are removed before April 1, 2009, and held on such date for sale by any person, there is hereby imposed a tax in an amount equal to the excess of–

(A) the tax which would be imposed under section 5701 of such Code on the article if the article had been removed on such date, over

(B) the prior tax (if any) imposed under section 5701 of such Code on such article.

(2) CREDIT AGAINST TAX- Each person shall be allowed as a credit against the taxes imposed by paragraph (1) an amount equal to $500. Such credit shall not exceed the amount of taxes imposed by paragraph (1) on April 1, 2009, for which such person is liable.

(3) LIABILITY FOR TAX AND METHOD OF PAYMENT-

(A) LIABILITY FOR TAX- A person holding tobacco products, cigarette papers, or cigarette tubes on April 1, 2009, to which any tax imposed by paragraph (1) applies shall be liable for such tax.

(B) METHOD OF PAYMENT- The tax imposed by paragraph (1) shall be paid in such manner as the Secretary shall prescribe by regulations.

(C) TIME FOR PAYMENT- The tax imposed by paragraph (1) shall be paid on or before August 1, 2009.

(4) ARTICLES IN FOREIGN TRADE ZONES- Notwithstanding the Act of June 18, 1934 (commonly known as the Foreign Trade Zone Act, 48 Stat. 998, 19 U.S.C. 81a et seq.) or any other provision of law, any article which is located in a foreign trade zone on April 1, 2009, shall be subject to the tax imposed by paragraph (1) if–

(A) internal revenue taxes have been determined, or customs duties liquidated, with respect to such article before such date pursuant to a request made under the 1st proviso of section 3(a) of such Act, or

(B) such article is held on such date under the supervision of an officer of the United States Customs and Border Protection of the Department of Homeland Security pursuant to the 2d proviso of such section 3(a).

(5) DEFINITIONS- For purposes of this subsection–

(A) IN GENERAL- Any term used in this subsection which is also used in section 5702 of the Internal Revenue Code of 1986 shall have the same meaning as such term has in such section.

(B) SECRETARY- The term ‘Secretary’ means the Secretary of the Treasury or the Secretary’s delegate.

(6) CONTROLLED GROUPS- Rules similar to the rules of section 5061(e)(3) of such Code shall apply for purposes of this subsection.

(7) OTHER LAWS APPLICABLE- All provisions of law, including penalties, applicable with respect to the taxes imposed by section 5701 of such Code shall, insofar as applicable and not inconsistent with the provisions of this subsection, apply to the floor stocks taxes imposed by paragraph (1), to the same extent as if such taxes were imposed by such section 5701. The Secretary may treat any person who bore the ultimate burden of the tax imposed by paragraph (1) as the person to whom a credit or refund under such provisions may be allowed or made.

(i) Effective Date- The amendments made by this section shall apply to articles removed (as defined in section 5702(j) of the Internal Revenue Code of 1986) after March 31, 2009.

SEC. 702. ADMINISTRATIVE IMPROVEMENTS.

(a) Permit, Inventories, Reports, and Records Requirements for Manufacturers and Importers of Processed Tobacco-

(1) PERMIT-

(A) APPLICATION- Section 5712 of the Internal Revenue Code of 1986 is amended by inserting ‘or processed tobacco’ after ‘tobacco products’.

(B) ISSUANCE- Section 5713(a) of such Code is amended by inserting ‘or processed tobacco’ after ‘tobacco products’.

(2) INVENTORIES, REPORTS, AND PACKAGES-

(A) INVENTORIES- Section 5721 of such Code is amended by inserting ‘, processed tobacco,’ after ‘tobacco products’.

(B) REPORTS- Section 5722 of such Code is amended by inserting ‘, processed tobacco,’ after ‘tobacco products’.

(C) PACKAGES, MARKS, LABELS, AND NOTICES- Section 5723 of such Code is amended by inserting ‘, processed tobacco,’ after ‘tobacco products’ each place it appears.

(3) RECORDS- Section 5741 of such Code is amended by inserting ‘, processed tobacco,’ after ‘tobacco products’.

(4) MANUFACTURER OF PROCESSED TOBACCO- Section 5702 of such Code is amended by adding at the end the following new subsection:

‘(p) Manufacturer of Processed Tobacco-

‘(1) IN GENERAL- The term ‘manufacturer of processed tobacco’ means any person who processes any tobacco other than tobacco products.

‘(2) PROCESSED TOBACCO- The processing of tobacco shall not include the farming or growing of tobacco or the handling of tobacco solely for sale, shipment, or delivery to a manufacturer of tobacco products or processed tobacco.’.

(5) CONFORMING AMENDMENTS-

(A) Section 5702(h) of such Code is amended by striking ‘tobacco products and cigarette papers and tubes’ and inserting ‘tobacco products or cigarette papers or tubes or any processed tobacco’.

(B) Sections 5702(j) and 5702(k) of such Code are each amended by inserting ‘, or any processed tobacco,’ after ‘tobacco products or cigarette papers or tubes’.

(6) EFFECTIVE DATE- The amendments made by this subsection shall take effect on April 1, 2009.

(b) Basis for Denial, Suspension, or Revocation of Permits-

(1) DENIAL- Paragraph (3) of section 5712 of such Code is amended to read as follows:

‘(3) such person (including, in the case of a corporation, any officer, director, or principal stockholder and, in the case of a partnership, a partner)–

‘(A) is, by reason of his business experience, financial standing, or trade connections or by reason of previous or current legal proceedings involving a felony violation of any other provision of Federal criminal law relating to tobacco products, processed tobacco, cigarette paper, or cigarette tubes, not likely to maintain operations in compliance with this chapter,

‘(B) has been convicted of a felony violation of any provision of Federal or State criminal law relating to tobacco products, processed tobacco, cigarette paper, or cigarette tubes, or

‘(C) has failed to disclose any material information required or made any material false statement in the application therefor.’.

(2) SUSPENSION OR REVOCATION- Subsection (b) of section 5713 of such Code is amended to read as follows:

‘(b) Suspension or Revocation-

‘(1) SHOW CAUSE HEARING- If the Secretary has reason to believe that any person holding a permit–

‘(A) has not in good faith complied with this chapter, or with any other provision of this title involving intent to defraud,

‘(B) has violated the conditions of such permit,

‘(C) has failed to disclose any material information required or made any material false statement in the application for such permit,

‘(D) has failed to maintain his premises in such manner as to protect the revenue,

‘(E) is, by reason of previous or current legal proceedings involving a felony violation of any other provision of Federal criminal law relating to tobacco products, processed tobacco, cigarette paper, or cigarette tubes, not likely to maintain operations in compliance with this chapter, or

‘(F) has been convicted of a felony violation of any provision of Federal or State criminal law relating to tobacco products, processed tobacco, cigarette paper, or cigarette tubes,

the Secretary shall issue an order, stating the facts charged, citing such person to show cause why his permit should not be suspended or revoked.

‘(2) ACTION FOLLOWING HEARING- If, after hearing, the Secretary finds that such person has not shown cause why his permit should not be suspended or revoked, such permit shall be suspended for such period as the Secretary deems proper or shall be revoked.’.

(3) EFFECTIVE DATE- The amendments made by this subsection shall take effect on the date of the enactment of this Act.

(c) Application of Internal Revenue Code Statute of Limitations for Alcohol and Tobacco Excise Taxes-

(1) IN GENERAL- Section 514(a) of the Tariff Act of 1930 (19 U.S.C. 1514(a)) is amended by striking ‘and section 520 (relating to refunds)’ and inserting ‘section 520 (relating to refunds), and section 6501 of the Internal Revenue Code of 1986 (but only with respect to taxes imposed under chapters 51 and 52 of such Code)’.

(2) EFFECTIVE DATE- The amendment made by this subsection shall apply to articles imported after the date of the enactment of this Act.

(d) Expansion of Definition of Roll-Your-Own Tobacco-

(1) IN GENERAL- Section 5702(o) of the Internal Revenue Code of 1986 is amended by inserting ‘or cigars, or for use as wrappers thereof’ before the period at the end.

(2) EFFECTIVE DATE- The amendment made by this subsection shall apply to articles removed (as defined in section 5702(j) of the Internal Revenue Code of 1986) after March 31, 2009.

(e) Time of Tax for Unlawfully Manufactured Tobacco Products-

(1) IN GENERAL- Section 5703(b)(2) of such Code is amended by adding at the end the following new subparagraph:

‘(F) SPECIAL RULE FOR UNLAWFULLY MANUFACTURED TOBACCO PRODUCTS- In the case of any tobacco products, cigarette paper, or cigarette tubes manufactured in the United States at any place other than the premises of a manufacturer of tobacco products, cigarette paper, or cigarette tubes that has filed the bond and obtained the permit required under this chapter, tax shall be due and payable immediately upon manufacture.’.

(2) EFFECTIVE DATE- The amendment made by this subsection shall take effect on the date of the enactment of this Act.

(f) Disclosure-

(1) IN GENERAL- Paragraph (1) of section 6103(o) of such Code is amended by designating the text as subparagraph (A), moving such text 2 ems to the right, striking ‘Returns’ and inserting ‘(A) IN GENERAL- Returns’, and by inserting after subparagraph (A) (as so redesignated) the following new subparagraph:

‘(B) USE IN CERTAIN PROCEEDINGS- Returns and return information disclosed to a Federal agency under subparagraph (A) may be used in an action or proceeding (or in preparation for such action or proceeding) brought under section 625 of the American Jobs Creation Act of 2004 for the collection of any unpaid assessment or penalty arising under such Act.’.

(2) CONFORMING AMENDMENT- Section 6103(p)(4) of such Code is amended by striking ‘(o)(1)’ both places it appears and inserting ‘(o)(1)(A)’.

(3) EFFECTIVE DATE- The amendments made by this subsection shall apply on or after the date of the enactment of this Act.

(g) Transitional Rule- Any person who–

(1) on April 1, 2009 is engaged in business as a manufacturer of processed tobacco or as an importer of processed tobacco, and

(2) before the end of the 90-day period beginning on such date, submits an application under subchapter B of chapter 52 of such Code to engage in such business, may, notwithstanding such subchapter B, continue to engage in such business pending final action on such application. Pending such final action, all provisions of such chapter 52 shall apply to such applicant in the same manner and to the same extent as if such applicant were a holder of a permit under such chapter 52 to engage in such business.

SEC. 703. TREASURY STUDY CONCERNING MAGNITUDE OF TOBACCO SMUGGLING IN THE UNITED STATES. This is enabling language for a resurrected version of last years PACT Act. Rep Weiner (D-NY) used the Homeland Security premise to launch PACT, which would ban the delivery of ANY tobacco product (except cigars) ordered by Internet or Telephone, domestic or imported, by individual citizens of the United States.

Not later than one year after the date of the enactment of this Act, the Secretary of the Treasury shall conduct a study concerning the magnitude of tobacco smuggling in the United States and submit to Congress recommendations for the most effective steps to reduce tobacco smuggling. Such study shall also include a review of the loss of Federal tax receipts due to illicit tobacco trade in the United States and the role of imported tobacco products in the illicit tobacco trade in the United States.

SEC. 704. TIME FOR PAYMENT OF CORPORATE ESTIMATED TAXES.

The percentage under subparagraph (C) of section 401(1) of the Tax Increase Prevention and Reconciliation Act of 2005 in effect on the date of the enactment of this Act is increased by 0.5 percentage point.

Speaker of the House of Representatives.

Vice President of the United States and

President of the Senate.

…………………………………………………………………………

Keep in mind that all of the above is in ADDITION to Rep Waxman’s (D-CA) drive to place all tobacco products including snus under FDA control.

This year is absolutely critical for all tobacco users (except cigar smokers) and especially for Swedish/Scandinavian Snus users. Reynolds in particular but the other Big American Tobacco Companies are going along with a lot of this entirely too easily. Reynolds is counting on Camel SNUS to be their big savior but of course that plan will go down in flames once Swedish/Scandinavian/REAL Snus becomes known and appreciated.

Swedish Match’s new GeneralSnus.com is offering free samples: 3 portions each of General Mini Mint, General Wintergreen, General Portion, and General White Portion. Relax mothers, their age verification process is so strict that it’s easier to get an illegal Social Security Card from the US Government than it is to get the free snus samples.

This has to be giving my former fantasy CEO, Susan Ivey of Reynolds, a stomach ache equal to what many Camel Frost users experience. Her plan depends on the continued ignorance of American tobacco users of any form of snus other than SNUS. The Empress has no clothes once the truth is known.

This is going to be a very interesting and very pivotal year for tobacco in general and for real snus lovers in particular. I hope you all love political activism because we’re going to have to start taking an active interest and role. The very future of Swedish Snus in America could very well be at stake.

Reporting from deep below the earth at the SnusCENTRAL Command Bunker,

Mr. UNZ

Activist Snus Guru

Shining the Light of Truth from SnusCENTRAL.org

About author

You might also like

Gotlandssnus to release two new Jakobsson’s Snus Flavors

Jakobsson’s Classic Strong Portion Snus and Jakobsson’s Mint Portion Snus coming soon. Swedish sources have confirmed the rumors are true concerning new snus from Gotlandssnus. Official sources in Sweden speaking

Snus Shake-up at Swedish Match!

Swedish Snus giant Swedish Match is making some major changes to it’s snus line-up for 2015. There will be new snus products starting this week and some current snuses will

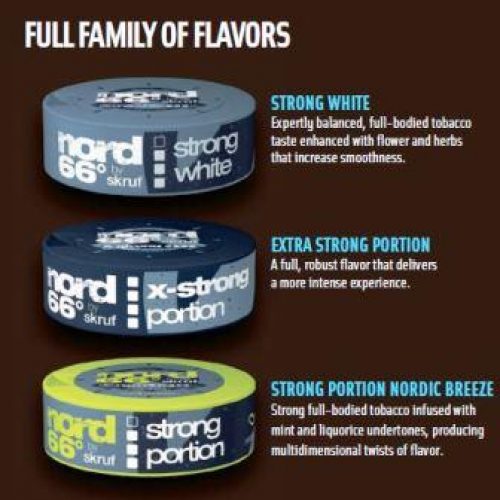

nord66° by skruf: A New Snus Brand to the Extreme

nord66° by skruf will bring a smile and nicotine to the mouths of Swedish snus lovers Skruf Snus AB is releasing three new snuses under their new nord66° (pronounced Nord