THE ROAD TO HELL IS PAVED WITH GOOD INTENTIONS – A Look Inside Taboca AS

Rumors, articles and independently confirmed facts underline the reality that Taboca AS, based in Oslo, Norway, and with production in Sweden on Gotland, has gone through a management overhaul.

I was acting MD, Scandinavia at Taboca from January 2007 until June, 2008, and have great admiration for the founding team. Tenacity, creativity, honesty, perspicacity, and the ability to turn on a dime were in abundance during my time with the Company. They had to be. Coming into a market dominated by Swedish Match and the large cigarette companies covetous of their own small snus market-shares, an independent upstart was hardly welcome.

I was acting MD, Scandinavia at Taboca from January 2007 until June, 2008, and have great admiration for the founding team. Tenacity, creativity, honesty, perspicacity, and the ability to turn on a dime were in abundance during my time with the Company. They had to be. Coming into a market dominated by Swedish Match and the large cigarette companies covetous of their own small snus market-shares, an independent upstart was hardly welcome.

But Taboca, founded in 2004 by Norwegian entrepreneurs Tom Ruud and Reinhard Rye, came into the market with licenses to produce, as snus, Montecristo and Romeo y Julieta, two iconic Cuban cigar brands belonging to Habanos SA. With an ex-Skruf Factory Director and a factory full of ex-Gotland staff, and US management, Taboca came onto the Scandinavian market in 2005 with the first true super-premium snus products: The soft-painted metal cans, and perfectly flavored snus including Cuban tobacco are aspirational sensations amongst moneyed Swedes and some Norwegians. In early 2007, it was decided to launch Taboca snus with no Cuban content as a price/value product, while keeping it in a metal can (the Company’s calling card, so to speak), and the brand has grown to include loose and strong mini-portions.

Julieta, two iconic Cuban cigar brands belonging to Habanos SA. With an ex-Skruf Factory Director and a factory full of ex-Gotland staff, and US management, Taboca came onto the Scandinavian market in 2005 with the first true super-premium snus products: The soft-painted metal cans, and perfectly flavored snus including Cuban tobacco are aspirational sensations amongst moneyed Swedes and some Norwegians. In early 2007, it was decided to launch Taboca snus with no Cuban content as a price/value product, while keeping it in a metal can (the Company’s calling card, so to speak), and the brand has grown to include loose and strong mini-portions.

In the US, Taboca was confronted by Philip Morris for the use of a name which was similar to one they were testing as a US snus at the time. In mid-2007, the issue was settled amicably, and US management changed Taboca USA to Nordic American Smokeless, going forward with plans to launch smokeless products in the US, and leveraging its Scandinavian expertise.

With almost no infrastructure investment beyond small branded ubiquitous (and attractive) Montecristo coolers, Taboca has managed to show trends in 2009 toward a one million can annual business. While 75% of this is Taboca-branded business, it is a staggering achievement considering investments made by Swedish Match’s competitors in Scandinavian brands and infrastructure. At JTI AB, 2.5% MS is achievable today in Sweden with over 60 people on the ground (as part of a full smoking portfolio). Taboca is trending toward 0.5% with only a handful of sales representatives.

Taboca AS’s Board may now look at the Company as ripe for sale, but Big Tobacco is already entrenched in snus. Imperial owns Skruf, and makes nothing from it relative to cigarettes, and will get the Cuban licenses once they expire anyway. PMI is out of Scandinavia as a snus producer, and JTI and BAT are rationalizing their portfolios. Cigarettes and Rolling Tobacco are top priorities for the main players in Scandinavia, so snus is simply just ‘so 2006.’

There is also the rumor that Taboca AS is looking to liquidate and shut down. With over US $20m in accumulated losses since incorporation in 2004 according to outgoing Board Chairman Luis Paulsen, Taboca AS could return to profit in two years. Yet, with the inertia inherent in the Scandinavian snus market, will the shareholders be willing to wait?

But wait. Those losses, a quarter of which were in 2008 alone, came not from the Scandinavian business, but from investments overseas, according to Mr. Paulsen. If one strips out the Nordic-American business entirely, here is what Taboca AS has as assets, both tangible, and intangible:

1. Manufacturing expertise. Best in the business, bar none.

2. Infrastructure. Taboca has ‘carried the bag’ in Norway and Sweden for several years now. With the help of Bonaventura AS, and now Gunnar Stenberg in Norway, and Habanos Nordic in Sweden, the company, which has its own team of tenacious sales reps as well, has developed a distribution footprint in Scandinavia which is worth a lot. Being Norwegian gives Taboca an “in” to the big national buying groups such as Norgesgruppen and Reitan. In Sweden, where the business is dominated by independent shops, Taboca Sweden has mapped them out, placed multiple coolers, and now services an enviable list of customers. The list comes without expensive market research and retail censuses. It comes from walking the streets, and meeting the clients face to face.

3. Brands. The licensed brands, Montecristo and Romeo y Julieta, are two of the finest snuses made. Little brother Taboca is not bad either. With an eye fixed on the EU legalizing snus, these are brands that could give ‘Bigger” Tobacco a run for its money. Taboca has done well as a volume brand, and requires support.

4. People. Taboca is good people. Founders to Factory to the streets of Stockholm and Oslo. Small and nimble, the company has always operated with a sense of urgency, entrepreneurialism, and a personal responsibility for every can that goes to market.

SO, WHAT HAPPENED?

COB Luis Paulsen paints a blurry picture in the Norwegian press. Yes. Millions of NOK went to the US business while the Scandinavian business was still in its infancy. It spooked the investors that so much money was headed west when the Scandinavian businesses were struggling to get on their feet.

COB Luis Paulsen paints a blurry picture in the Norwegian press. Yes. Millions of NOK went to the US business while the Scandinavian business was still in its infancy. It spooked the investors that so much money was headed west when the Scandinavian businesses were struggling to get on their feet.

The Swedish business was slow out of the gate due to the contractual requirement that Taboca distribute via Habanos’ own company-owned distributor in Sweden. Habanos Nordic AB had a general distribution footprint of 500 shops in Sweden, mostly serious tobacconists, in a universe of 7,000, 2,000 of which sell 80% of all snus in Sweden. Together with the management of Habanos Nordic, it took Taboca two years to convince Habanos senior management in Madrid to allow the companies to use Swedish Match Distribution, which covers 99% of all mass-market tobacco in Sweden. This delay was due to long-term reluctance based on the fact that Swedish Match and Habanos continue to dispute the ownership of the Cohiba cigar brand in the US (SM has it, Habanos does not).

Additionally, the products were launched during a two-year period where the new Swedish government had instituted the first excise tax hikes on snus in 10 years: 100% in 2007, and 50% in 2008. Taboca AS was launching super-premium products at a time when the market shed what would eventually be 10% of its volume in the first quarter of 2007 due to staggering price hikes, especially for loose products (excise tax is weight-based). Many loose products were thus reduced to 45g to defray some of the extra cost.

Distribution solved, and with Taboca having created its own sales force structure in the meantime, the company was finally able to focus on the business of selling snus in Sweden.

The Norwegian side of the business, however, was more troublesome, and for all the wrong reasons. The founders, investors, and Board, being Norwegian (except for one) were obsessed with the success of the brands in Norway. In a 250m can total Scandinavian market, Norway comprises under 10% of the total volume. With Montecristo and Romeo y Julieta off to a good start in test in an upscale sandwich chain in Oslo, the company was able to secure listings in 7-11 and other chains as well, and this in an environment where a distributor/national wholesaler has the right to refuse to list your product based on the skeptical Head Buyer’s opinion, and where Swedish Match has 83% Market Share.

Nevertheless, it is a clear reality that a Norwegian snus business, even with time and money invested, is not a business at all. Imperial pats itself on the back for the 2 million cans of Skruf it sells in Norway every year, and its double-digit marketshare. But it’s small potatoes for Imperial in a regional market of 250m cans. For Taboca AS, Norway was, in hindsight an obsession over a market which would never be profitable, and it wasted too much management time on tiny and uncontrollable supply-chain driven issues caused by Norway’s oligopolistic distribution system.

In the meantime, with Scandinavia having taken longer than expected, CEO Darren Quinn and the US team, all ex-UST management, were focusing on a strategy for the US. With distribution secure, and  brands (Klondike, Nordic Ice) in development at Taboca’s Gotland factory, there was investment needed to upgrade Swisher’s West Virginia smokeless factory to accommodate Stateside production of the new products.

brands (Klondike, Nordic Ice) in development at Taboca’s Gotland factory, there was investment needed to upgrade Swisher’s West Virginia smokeless factory to accommodate Stateside production of the new products.

Klondike was to be marketed and sold as traditional dip in fine and long cuts and pouches across several flavor lines, while Nordic Ice was envisioned as a dry flavored portfolio of mini portions with an upscale feel aimed at adult smokers looking for a complementary tobacco product when use of cigarettes is not legal or appropriate. Fair enough.

The US smokeless market in the mid-2000’s was (and remains) approximately one billion cans per year with about 2% year-on-year growth. Swedish Match had been trying to market snus in urban areas for almost a decade, and was bolstered by a strong US cigar, dip and chew/plug business led by brands such as Red Man and Longhorn. RJR was testing snus produced at Fiedler and Lundgren called “Camel” in the US, and Philip Morris was testing something called “Taboka Snus” and was rumored to be buying boatloads of machines from Mertz (Germany) and working on proprietary technology with GD (Italy). RJR then bought US smokeless giant Conwood in 2006 for $3.5 billion.

The time seemed ripe to ‘get in.’ Certainly with attention being paid to snus/smokeless by US Big Tobacco, it meant that increasingly widespread smoking restrictions were forcing the big boys to look at alternatives to cigarettes. Their large long-term investments would pave the way for smaller producers to put snus in the mouths of smokers.

By early 2008, Nordic American had leased a modest office in a small office park in Danbury, Connecticut, and were plucking regional sales management and oral employment commitments from UST’s existing staff. The top managers had leased new Audi A6 sedans to pre-celebrate a great future which was in fact, far from guaranteed.

WRITING ON THE WALL

Meanwhile, with the global recession in its adolescence, but yet to be announced, funding was becoming harder and harder to obtain. CEO Quinn spent no time selling snus, and all his time flying around Europe or in New York looking for capital. When it came, it always came at the last minute. Salaries were paid first, can orders from China second, and commitments to equipment suppliers and US ad agencies came third.

The paradox Taboca faced was that, in order to sell the business as an opportunity to new investors, the company had to use the Scandinavian success story as its primary tool. And that very story was now threatened by the continued investment into the USA. And the USA had developed to the point that Taboca AS could not cut funding.

In Sweden, we were two men short on the ground, and six months’ back in office rent. I stopped speaking with ad agencies about re-branding the company and upgrading its tired website. We scrapped trendy club listings for the Cuban brands. In Norway, the only sales rep was let go.

Then there were the delays. Chinese cans, first defective, than delayed again (for all markets), and Italian production equipment (by lack of funds) only topped the long list in the US. It was early Spring 2008 when the question was first raised by individual Board members: What if we get rid of America? It was a phone call from Luis Paulsen to founding partner, Tom Ruud which I witnessed. Darren Quinn, already seeking independent US funding, came to Oslo, and defended NAS passionately, warning of the potential legal and reputational ramifications of doing so at this late date. Swisher was signed on, as were several regional managers. Products were ready to go, and expos booked.

In Sweden, I realized things were that bad when I had arranged a back-page ad for the full Taboca portfolio in the pre-eminent tobacco trade journal in all of Scandinavia, Tobak & Mer (to announce our new association with Swedish Match Distribution to the trade). It cost only $5000. I authorized the spend as part of a planned and agreed marketing budget, which Taboca AS was beating monthly. I received a call from the US asking quite impolitely how I could have spent so much money on an ad.

CHINA

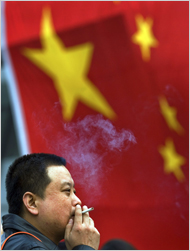

In March of 2008, Founder Ruud and I traveled to Zhengzhou, China with our Production Director to meet with the research department of the CNTC (Chinese National Tobacco Company), the national monopoly. They had sent a delegation to Oslo the year before and met with us at the behest of our tobacco broker, and we were accepting the traditional return invitation. In a one trillion cigarette market, it was little Taboca, the “baby tiger” as they called us, that would present snus to their directors. We would also present Taboca’s willingness to get involved by providing snusmaking expertise.

In March of 2008, Founder Ruud and I traveled to Zhengzhou, China with our Production Director to meet with the research department of the CNTC (Chinese National Tobacco Company), the national monopoly. They had sent a delegation to Oslo the year before and met with us at the behest of our tobacco broker, and we were accepting the traditional return invitation. In a one trillion cigarette market, it was little Taboca, the “baby tiger” as they called us, that would present snus to their directors. We would also present Taboca’s willingness to get involved by providing snusmaking expertise.

It was a hard-sell to US Senior Management. Cigarette companies who announce burgeoning relationships in China often see their stock prices rise on that very day. Gallaher, BAT and PM have all been there and done so, and their persistence in that difficult and bureaucratic country have led to footholds in the largest tobacco market in the world. I tried to convince Danbury that this could be a major coup for attracting investors. We were told to get a Letter of Intent signed immediately. The letter was apparently delivered to the ministry in Beijing, but we were warned that “immediately” is an unknown word in the Chinese government bureaucracy.

In late Spring my contract was allowed to expire.

WHAT WENT WRONG?

Timing. Taboca AS was crippled by the two aforementioned excise changes, and an impending lack of funds which first came from an aversion to the tobacco business amongst Norwegian investors, and then the nascent worldwide recession. They were also delayed by stubborn old-line management within Habanos whose knowledge of tobacco beyond cigars was nil.

There was always the hope that prioritizing US funding would produce a quick turn to profit there which would offset the slow growth in Scandinavia, and attract new investment quickly. But the big US snus ‘explosion’ never came. RJR mauled the market with cheap or free Camel snus, and Philip Morris continues to test in its bunker. Lorillard still silently tests Triumph, and Liggett at this point has probably had its fill of testing Grand Prix and Tourney.

Nordic American’s initial push on the US market went largely unnoticed. Snusers sought product out, yet could not find it. Those that could found the products inexplicably sweet, and in the case of Nordic Ice especially, found the product’s nicotine delivery to be unsatisfactory. Klondike products were soon reported on the web to be in gas station discount bins in the southeastern US at $0.99 per can. Both products suffered from what was said to to be lack of consumer-based marketing, poor availability, and confusion as to what the products were,

One issue was that Nordic American had made a last minute change of its Klondike product label, and decided to call it ‘snus’ because of calls in the trade to do so. Perhaps desperate for that first big sale, they violated the rule of thinking of ‘the trade’ as the fat cats who show up at an expo, and not the tens of thousands of shops they serve, and who have daily consumer contacts. I have dragged multi-millionaire tobacco distributors into shops several times in my career to alter their perceptions of what actually occurs in the field beyond AC Nielsen numbers. Also, consumer awareness of snus among dippers requires prolonged investment in education and consumer trial.

Additionally, snus has become the first legitimate viral tobacco product. Thanks to the growth of on-line snus commerce sites (www.snuscentral.com being amongst the most venerable), online sales has grown into a multi-million can annual overall business. Many snus users eschew traditional tobacco marketing channels, and head straight to these sites, and to independent consumer sites such as www.snuscentral.org and several others. Swedish Match is using these Internet resources as a way to reach out personally to consumers, debunking myths, discussing flavors and issues of harm reduction. They are creating word-of-mouth ambassadors out of these educated cyber-consumers as they prepare for their formal US snus launches. Denmark’s V2 has a successful Internet-only commercial model and believes in a high degree of contact with identified consumer trendsetters around the world. Gotlandssnus is now doing the same. Both Camel and Marlboro snuses have busy 18+ Internet sites in the US as well.

Nordic American, as a small snus company, should have taken the Internet by the horns early. Yet, Version 1.0 of their site posed more questions than answers about their products, and, after publicly showing that one of its managers was let go, went into a permanent maintenance cycle. Meanwhile, consumer forums have asked questions about the products’ flavors, strength, and availability, even asking NAS to produce a ‘real’ snus in America. No response.

Before the recent announcement, NAS had already been operating independently of the Norwegian business for some time. The events of last week simply formalized it. I hope they find their market.

TABOCA AS: WHERE TO NEXT?

If the Norwegian Board is dedicated to seeing Taboca AS run effectively as an ongoing concern, the punch-list must include the following:

1. The new CEO must be ex-Big Tobacco with knowledge of snus and the Swedish and European businesses outside of snus. This is key locally, and in relations with Imperial and the Competition in Sweden.

2. A marketeer is needed (also from Tobacco) who can follow currently changing trends in flavors/strengths/designs. New product development has stopped since last year in the Company while market preferences have diversified. Must be Swedish due to lack of tobacco marketing in Norway (and thus, lack of tobacco marketeers)

3. An “Internet” model: V2 is a profitable pure Internet company. Gotland is moving in that direction. Taboca must formulate new brands strictly for web-based commerce. The US has been a developing “extra strong” market now for several years based, surprisingly, on products designed for Norwegian tastes.

4. Realization that the Norwegian snus market is immaterial to the success of the company without a realistic timeframe of 5 to 10 years, with investment. With a ‘dark market’ potentially looming, the Norwegian commercial business should be considered ripe for closure or an exclusive focus on airport duty-free and passive sales only.

5. The company must invest in research and hire an expanded Swedish team with focus on key accounts and duty free outside of Habanos Nordic AB

6. The company must have an EU strategy both with and without Habanos SA (preferably with).

7. The Board must rely on its management to make product and distribution decisions in the marketplace.

8. The Company must (finally) get a Finance Director who is commercially focused (bonused on volume and profit)

With snus as a potentially transformative tobacco product in both the EU and the US, it is best approached with a combination of youthful innovation, a sack of money, good market intelligence and endless patience. Perhaps in the future, Taboca’s Norwegian Board will have retained something from the Americans about the value moving quickly in a market, and NAS will have a takeaway from the Norwegians that patience is indeed a virtue.

ANDREW ROMEO

From my Perspective…

Reporting for SnusCENTRAL.org

About author

You might also like

Is Big Tobacco Selling Harm Reduction?

No and Yes. One thing must remain clear. Big Tobacco wants its legal consumers to smoke as many cigarettes as possible. The bulk of their marketing, where it is allowed

Tobacco, Restaurants and Donuts: Be in Touch With Your Consumer

We live in an age where individual consumers can comment about products and services on the Internet, and make an immediate impact on the companies who provide them. That is,

The (other) Great White North

Starting next week, I will be posting from my old ‘stomping ground’ of Russia. Specifically, I have accepted a consultancy appointment with a drinks company in St. Petersburg, and will